2️⃣Tracer solution

2.1. Background

As discussed in the previous section, the current carbon dioxide removal (CDR) market is dominated by projects focused on reducing future emissions, which, while valuable, are insufficient to address the vast amount of CO2 that has already accumulated in the atmosphere. To meet the urgent need for gigaton-scale carbon removal, the market must rapidly scale up and embrace a wide range of CDR solutions, including both nature-based and engineered approaches.

However, the fragmented nature of the current market, lack of standardization, and limited liquidity pose significant challenges to achieving this goal. Trust in the quality and integrity of carbon credits is undermined by the absence of transparent verification processes and the risk of reversals. Additionally, the complexity of navigating multiple projects, standards, and platforms hinders accessibility and efficiency for both buyers and suppliers.

Tracer is the foundational layer enabling the digitization of the carbon removal industry. It aims to address these challenges by providing a disruptive blockchain-based solution that delivers both trust and liquidity to the CDR market. By leveraging smart contracts and advanced financial functionality, Tracer creates a unified solution for the issuance, trading, and management of high-quality carbon removal credits.

2.2 Technical overview

Tracer has developed an innovative solution to address the paradox of achieving liquidity and traceability in the carbon removal token market. Traditionally, carbon credits have been either liquid but untraceable (generic fungible tokens) or traceable but illiquid (project-specific over-the-counter transactions). Tracer's approach overcomes this challenge by leveraging a single smart contract to create project-specific, graded, and fungible tokens that keep their traceability at all times.

Tracer's technical solution is built upon core principles that enable it to create a transparent, scalable, and efficient carbon removal market:

Persistence grading

By assigning a higher value to more persistent removal methods, such as enhanced weathering (which can store CO₂ for 100,000+ years), Tracer rewards long-term, effective solutions.

Tracer introduces the concept of "grade" as an indicator of the persistence of carbon sequestration. This allows for an objective comparison of different CDR projects based on the longevity of their carbon storage. By assigning a higher value to more persistent removal methods, such as enhanced weathering (which can store CO2 for 100,000+ years), Tracer creates a market that rewards long-term, effective solutions.

Additionally, the grading system addresses the ephemeral nature of each project by tying the value of the tokens to the duration of carbon storage. As tokens are minted and then retired over time, the market can accurately reflect the value of the carbon removal based on its persistence. This entire process is recorded using blockchain technology to ensure immutable traceability.

To achieve the goal of removing the 2.2 trillion tons of excess CO2 in the atmosphere, Tracer's system is designed to be highly scalable. By delegating project curation and management to endorsed entities, Tracer minimizes overhead and enables the inclusion of a wide range of removal solutions, from established methods to novel approaches. This scalability is essential to reach the tens of thousands of projects needed to make a significant impact on atmospheric CO2 levels.

Scalability

Tracer is designed to be highly scalable. By delegating project curation and management to endorsed entities, Tracer minimizes overhead and enables the inclusion of a wide range of removal solutions.

Trust and governance

Trust is a crucial factor influencing the price and adoption of carbon removal credits. Tracer ensures trust through two key mechanisms: traceability and governance. First, every token ID contains information about the specific project and endorser, providing complete traceability of the carbon removal process. Second, strong governance and enforcement capabilities, enabled by the Tracer DAO, ensure the integrity of the system and allow for the swift action against any misrepresentation of performance.

Liquidity

Tracer recognizes that liquidity is essential for price discovery, market stability, and growth. To achieve this, Tracer employs a single ERC1155 smart contract for all projects, creating a standardized and efficient framework for issuing and trading carbon removal tokens. This standardization, combined with the tokens' compatibility with decentralized finance (DeFi) platforms, enables the creation of advanced financial instruments that can further boost market growth and liquidity.

For example, the Carrot tokens allow for the development of sophisticated products such as carbon removal credit futures, which enable sellers to secure funding for their projects by selling credits before they are delivered. The creation of collections of tokens grouped by persistence grade or project type, known as "Baskets of Carrot Tokens", enables investors to easily access and trade diversified portfolios of carbon removal credits, increasing liquidity and market efficiency.

Tracer's unique value proposition lies in its approach to creating project-specific, graded, and fungible tokens through a single smart contract that effectively solves the liquidity-traceability paradox. Here's how it works:

Project-specific tokens: Each carbon removal project is represented by a unique token ID within the ERC1155 smart contract. This ensures that every token is linked to a specific project, maintaining full traceability of the carbon removal process.

Graded tokens: Tokens are assigned a grade based on the persistence of the carbon sequestration method used by the associated project. This grading system allows for the objective comparison of different projects and enables buyers to make informed decisions based on their preferences for long-term impact.

Fungible tokens: While each token is linked to a specific project, tokens with the same grade are fungible within their persistence category. This means that buyers can easily trade and exchange tokens within the same grade, without losing the traceability of the underlying projects. This fungibility is crucial for creating a liquid market that supports price discovery and efficient trading.

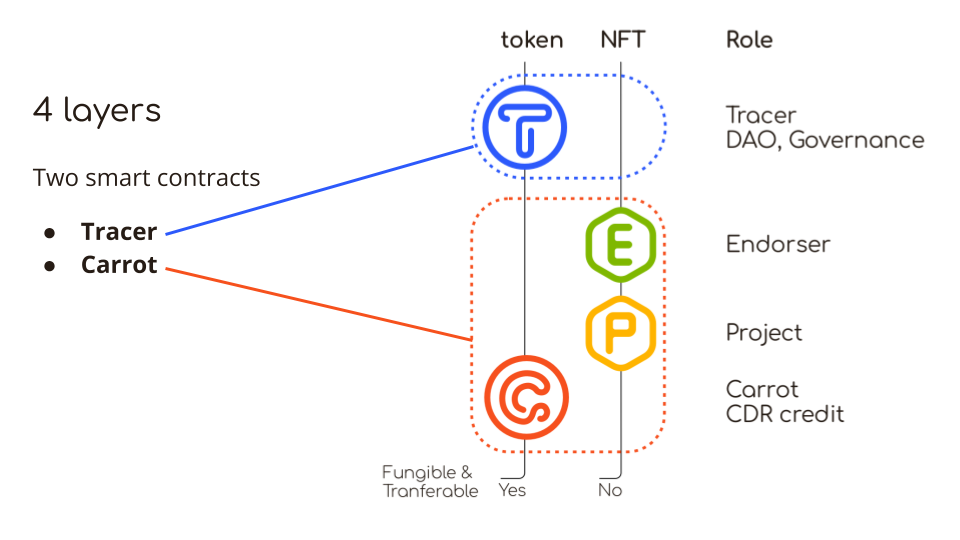

2.3 Dual-Token System

In order to build solutions and govern the Tracer ecosystem, Tracer is based on a smart contract architecture consisting of two primary components:

Tracer Token (ERC20)

The governance token of the Tracer ecosystem, used for voting on key decisions and incentivizing participation in the ecosystem.

Carrot Token (ERC1155)

A fungibility-agnostic token representing 1000 kilograms of CO2 removed. Carrot tokens are minted by Project Developers and contain metadata on the associated CDR project at all times, ensuring a high level of transparency and traceability.

The Tracer ecosystem is governed by the Tracer DAO, which is responsible for selecting Endorsers, managing the treasury, and ensuring the overall integrity of the system. Tracer tokens are used to align incentives within the DAO, as their value is directly tied to the growth and success of the Carrot economy.

2.4 The Tracer Token ($TRCR)

The Tracer token (TRCR) is an ERC20 token with a pre-minted supply, serving as the governance backbone of the Tracer ecosystem. Key features and functions of the Tracer token include:

Governance: $TRCR holders can vote on crucial protocol decisions, such as upgrading smart contracts, granting or revoking Endorser NFTs, and managing the Tracer DAO treasury, ensuring decentralized control and community-driven development.

Deflationary mechanism: A portion of the minting fees collected from the creation of Carrot tokens is used to buy back and burn $TRCR, creating deflationary pressure and potentially increasing the value of remaining Tracer tokens over time.

Staking and incentives: A staking mechanism is proposed in which $TRCR tokens can be staked by Endorsers and project developers as a form of collateral, aligning their interests with the long-term success of Tracer, for example to enable carbon credit futures, in which a certain risk to the buyer has to be managed. Staked tokens may be eligible for rewards, further encouraging participation and commitment to the ecosystem.

2.5 The Carrot Token ($CRRT)

The Carrot token (CRRT) is an ERC1155 token that represents a specific amount of CO2 removed from the atmosphere. It is designed to be fungibility-agnostic, combining features of both ERC20 and ERC721 standards to enable efficient management of multiple token types within a single smart contract. Key features and functions of the Carrot token include:

Representation of carbon removal: Each Carrot token represents a specific amount of CO2 removed, with one token equating to one ton of CO2. The metadata associated with each token provides information on the associated CDR project, Endorser, and removal process.

Grading system: Carrot tokens are classified into different grades based on the persistence of the carbon removal they represent. This grading system enables price stratification and allows buyers to make informed decisions based on their preferences and risk tolerance.

Minting and supply control: Carrot tokens are minted by approved Endorsers, who are granted Project NFTs by the Tracer DAO. These Project NFTs specify the grade, name, and maximum supply or minting rate of the associated Carrot tokens, ensuring controlled and transparent issuance.

Utility and tradability: Carrot tokens can be bought, sold, and traded on various platforms, including decentralized exchanges (DEXs) and carbon markets. They may also be used for offsetting purposes, retired, or burned to demonstrate the cancellation of a specific amount of CO2 emissions.

Contribution to Tracer DAO: A small percentage (e.g., 2%) of minted Carrot tokens are automatically transferred to the Tracer DAO treasury, providing a source of revenue for the ecosystem and aligning the interests of Carrot token minters with the overall success of the ecosystem.

The dual-token system employed by Tracer creates a symbiotic relationship between governance and utility, ensuring that the ecosystem remains decentralized, transparent, and focused on its core mission to unlock the potential of the carbon removal market.

2.6 Tracer applications as market infrastructure technology

By leveraging the features of the Carrot smart contract, such as the ERC1155 token standard and the grading system, Tracer unlocks a wide range of possibilities for financial applications that can drive significant economic value and accelerate the growth of the carbon removal industry.

The introduction of liquidity in the carbon removal market through Tracer's disruptive blockchain solution is a game-changer, enabling the creation of advanced financial products that were previously impossible due to the lack of transparency and standardization. With Tracer's technology, the $80 billion carbon credit market can now tap into the vast potential of DeFi, opening up new opportunities for investors, project developers, and other ecosystem members.

Carrot token futures: a key driver of adoption

One of the most significant applications of Tracer's technology is the development of Carrot token futures. Carbon removal project developers or credit sellers face a major challenge in securing funding to start and scale their projects. This is particularly important because carbon removal credits are currently more expensive than carbon credits derived from reduction and avoidance initiatives.

Tracer's strategy is to address this challenge by enabling the creation of financial instruments that allow sellers to sell carbon removal credits before they are delivered. This approach provides several benefits:

Guaranteed price for buyers: By purchasing Carrot token futures, buyers can lock in a guaranteed price for their carbon removal credits, potentially securing a discount on the final market price when the credits are delivered.

Funding for sellers: Sellers can use the commitment from buyers to obtain financing for their projects, providing them with the necessary capital to start and scale their operations. This is crucial for bringing down the costs of carbon removal credits and making them more competitive with other types of carbon credits.

Risk mitigation: Futures contracts help to mitigate risks for both buyers and sellers by providing price certainty and reducing exposure to market volatility.

Market efficiency: The trading of Carrot token futures contributes to improved price discovery and market efficiency, as market participants can use these instruments to express their views on future supply and demand dynamics.

Baskets of Carrot tokens

Baskets are essentially collections of Carrot tokens that are grouped together based on specific criteria, such as their persistence grade or the type of carbon removal project they represent. By creating these baskets, Tracer enables investors and other participants to easily access and trade a diversified portfolio of carbon removal credits, without having to manage multiple token contracts or navigate the complexities of the underlying projects.

The benefits of Carrot token baskets include:

Diversification: By holding a basket of Carrot tokens, investors can spread their risk across multiple projects and persistence grades, reducing their exposure to any single project or carbon removal method.

Liquidity: Carrot tokens can be easily traded on decentralized exchanges (DEXs) or other DeFi platforms, providing investors with a high degree of liquidity and the ability to quickly enter or exit positions based on market conditions.

Customization: Baskets of Carrot tokens can be customized to meet the specific needs and preferences of different investors, such as those who prioritize long-term carbon sequestration or those who want to support specific types of carbon removal projects.

Price discovery: By creating a market for baskets of Carrot tokens, Tracer enables more efficient price discovery for different grades and types of carbon removal credits, helping to establish benchmark prices and improve overall market transparency.

DeFi applications

The combination of Carrot token baskets, futures contracts, and other advanced financial instruments creates the foundation for the development of fully decentralized carbon removal exchanges. These exchanges can leverage Tracer's technology to provide a secure, transparent, and efficient platform for the trading of carbon removal credits, enabling market participants to access a wide range of financial products and services.

Key features of decentralized carbon removal exchanges include:

Accessibility: By leveraging blockchain technology and DeFi protocols, decentralized exchanges can provide access to a global pool of investors and project developers, regardless of their location or financial status.

Transparency: All transactions and market data on decentralized exchanges are recorded on the blockchain, providing a high degree of transparency and immutability.

Security: Decentralized exchanges utilize smart contracts and other blockchain-based security measures to ensure the safety and integrity of user funds and transactions.

By unleashing the potential of advanced financial instruments and services Tracer is not only revolutionizing the carbon removal market but also creating a new paradigm for sustainable finance.

Last updated